Financials

Unaudited Financial Statements And Dividend Announcement For The Six Months And Full Year Ended 31 December 2023

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

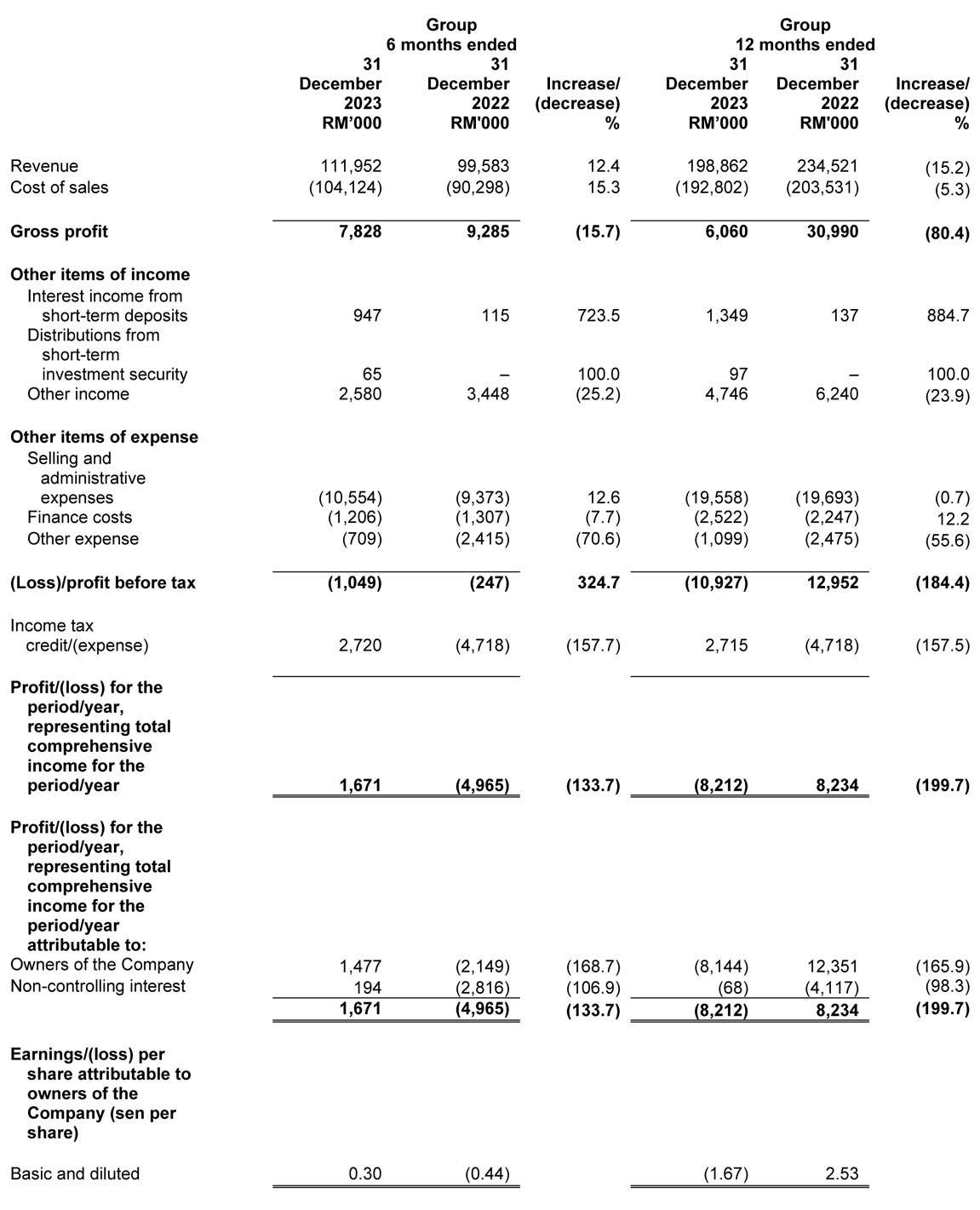

CONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

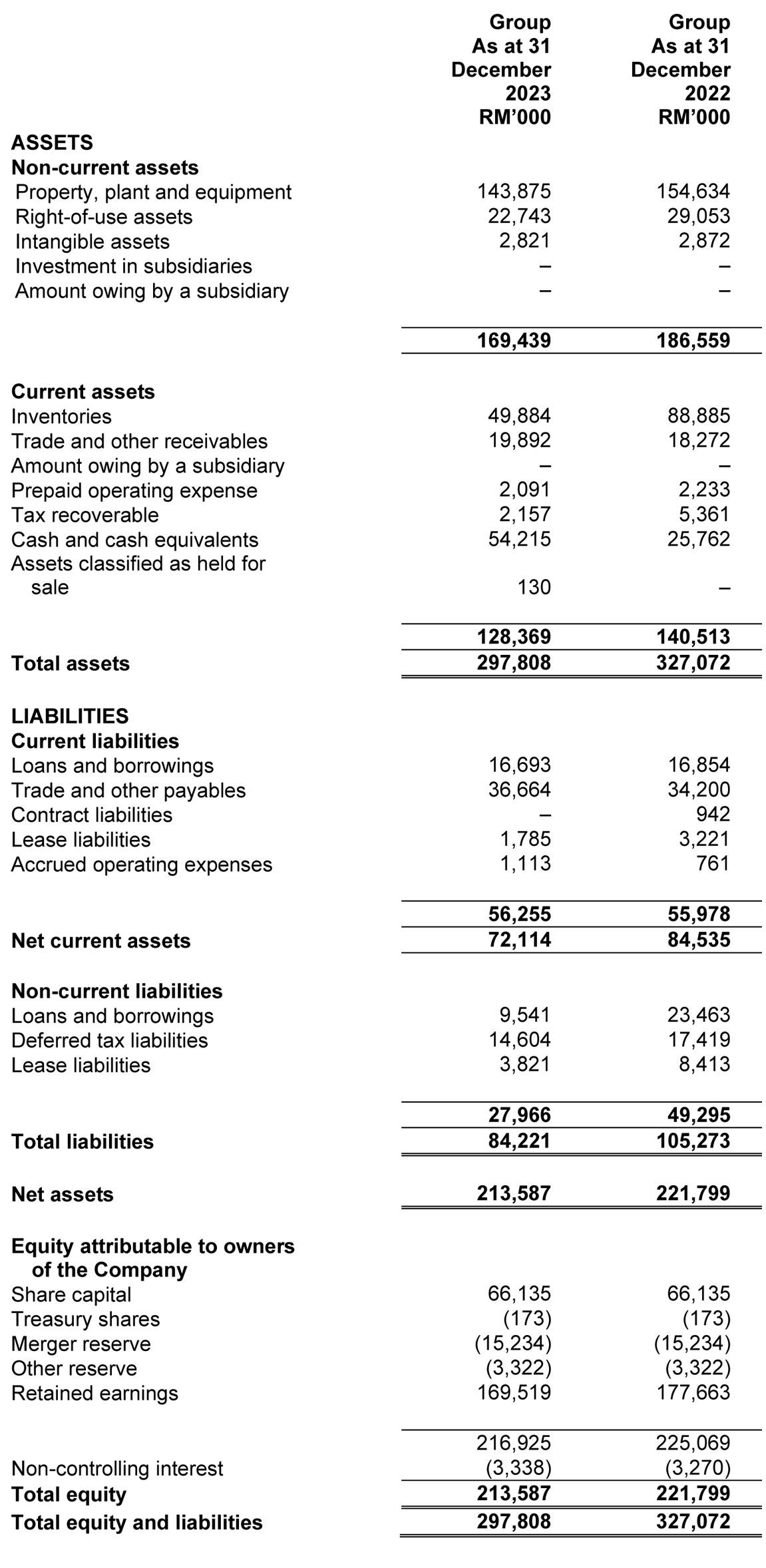

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITION

Review of Performance

CONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

Review of Group’s performance for the 6 months ended 31 December 2023 (“2H2023”) as compared to the 6 months ended 31 December 2022 (“2H2022”)

RevenueThe Group’s revenue increased by approximately RM12.3 million, or 12.4%. This was mainly attributable to the increase in the average selling price per 40-ft container which increased from RM74,000 in 2H2022 to RM89,000 in 2H2023 as a result of the different product mix sold by the Group. The Group also benefitted from the higher exchange rate for USD in 2H2023 as compared to 2H2022. As a reference, the closing exchange rate of US$1 against the Malaysian Ringgit was RM4.40564 as at 31 December 2022 and strengthened to RM4.5925 as at 31 December 2023.

However, the increase was partially offset by a decrease in the number of 40-ft containers sold from 1,337 40-ft containers in 2H2022 to 1,260 40-ft containers in 2H2023.

Cost of sales and gross profits

Cost of sales increased by approximately RM13.8 million, or 15.3%, mainly due to more material used (due to different product mix), labour cost in line with increase in revenue in the Millwork segment as well as higher allowance provided for slow moving inventories as the Group discontinued some of its product models. However, the increase was partially offset by a decrease in subcontractors’ costs due to lesser work being contracted to subcontractors.

As a result of lower percentage increase in revenue as compared to our cost of sales, the Group’s gross profit margin decreased from 9.3% in 2H2022 to 7.0% in 2H2023.

Interest income

Interest income increased by approximately RM0.8 million, or 723.5%, mainly due to higher cash placements in short term fixed deposits in the bank account maintained in Malaysia and higher overnight interest rate offered in 2H2023.

Distributions from short-term investment security

Distributions from short-term investment security comprised income received for funds placed with Money Market Funds during 2H2023.

Other income

Other income comprised mainly government grants, rental income and scrap as well as charges for services provided such as transportation.

Other income decreased by approximately RM0.9 million, or 25.2%, mainly due to the decrease in machine rental received and processing fee income. However, this was partially offset by an increase in factory rental received.

Selling and administrative expenses

Selling and administrative expenses increased by approximately RM1.2 million, or 12.6%, mainly due to the higher staff costs and change in the depreciation rate of office computer equipment and computer software from 10% to 20% in 2H2023.

Depreciation expenses

Depreciation expenses increased by approximately RM0.1 million, or 1.5% mainly due to the change in the depreciation rate of office computer equipment and computer software from 10% to 20% as stated in N2.2 of this announcement. The increase was partially offset by a decrease in depreciation expenses for right-of-use assets due to early termination of tenancy agreements.

Finance costs

Finance costs decreased by approximately RM0.1 million, or 7.9% mainly due to early termination of tenancy agreements. However, the decrease was partially offset by an increase in interest charged on the term loans in 2H2023.

Other expense

Other expense decreased by approximately RM1.7 million, or 70.6%. The decrease is mainly due to the Group incurred lower net foreign exchange loss of RM0.7 million in 2H2023 as compared to net foreign exchange loss of RM2.4 million in 2H2022 due to decrease in USD-denominated trade and other payables as well as USD-denominated loans.

Income tax expense

The Group recorded an income tax credit of approximately RM2.7 million in 2H2023 compared to income tax expense of approximately RM4.7 million in 2H2022. This was due to reversal of temporary difference in FY2023 and overprovision of deferred tax in respect of previous years. As a result of decrease in the provision of deferred tax liability, income tax expense for 2H2023 decreased by approximately RM7.4 million, or 157.7%.

Profit for the period

As a result of the income tax credit recorded by the Group as explained above, the Group recorded net profit of approximately RM1.7 million in 2H2023 as compared to a net loss of RM5.0 million in 2H2022.

Review of Group’s performance for FY2023 as compared to FY2022

RevenueThe Group’s revenue decreased by approximately RM35.7 million, or 15.2%. This was mainly attributable to the decrease in the number of 40-ft containers sold from 3,220 40-ft containers in FY2022 to 2,346 40-ft containers in FY2023.

However, the decrease was partially offset by an increase in the average selling price per 40-ft container which increased from RM73,000 in FY2022 to RM85,000 in FY2023 as a result of the different product mix sold by the Group and the stronger USD in FY2023 as compared to FY2022. As a reference, the closing exchange rate of US$1 against the Malaysian Ringgit was RM4.40564 as at 31 December 2022 and it strengthened to RM4.5925 as at 31 December 2023.

Cost of sales and gross profits

Cost of sales decreased by approximately RM10.7 million, or 5.3%, mainly due to the decrease in labour cost, subcontractors’ cost as well as freight and handling charges in line with decrease in sales volume. However, the decrease was partially offset by an increase in allowance for slow moving inventories as the Group discontinued some of its product models.

As a result of the decrease in sales, the Group’s gross profit decreased by approximately RM24.9 million or 80.4%. The Group’s gross profit margin decreased from 13.2% in FY2022 to 3.0% in FY2023.

Interest income

Interest income increased by approximately RM1.2 million, or 884.7%, mainly due to higher cash placements in short term fixed deposits in the bank account maintained in Malaysia as there has been an increase in cash and cash equivalents and higher overnight interest rate offered in FY2023.

Distributions from short-term investment security

Distributions from short-term investment security comprised income received for funds placed with Money Market Funds during FY2023.

Other income

Other income comprised mainly government grants, rental income, sale of timber, boards, hardware and scrap as well as charges for services provided such as transportation.

Other income decreased by approximately RM1.5 million, or 23.9%, mainly due to the decrease in machine rental received and processing fee income. However, this was partially offset by an increase in factory rental received.

Selling and administrative expenses

Selling and administrative expenses decreased by approximately RM0.1 million, or 0.7%, mainly due to the decrease in staff costs and directors’ bonus. However, this was partially offset by an increase in depreciation expenses due to change in the depreciation rate of office computer equipment and computer software from 10% to 20%.

Depreciation expenses

Depreciation expenses increased by approximately RM0.4 million, or 2.7% mainly due to the change in the depreciation rate of office computer equipment and computer software from 10% to 20%.

Finance costs

Finance costs increased by approximately RM0.3 million, or 12.2% mainly due to an increase in interest charged on the term loans in FY2023. However, the increase was partially offset by the early termination of tenancy agreements.

Other expense

Other expense decreased by approximately RM1.4 million, or 55.6%. The decrease was mainly due to the Group incurred lower net foreign exchange loss of RM1.0 million in FY2023 as compared to net foreign exchange loss of RM2.4 million in FY2022 due to decrease in USD-denominated trade and other payables as well as USD-denominated loans.

Income tax expense

The Group recorded an income tax credit of approximately RM2.7 million in FY2023 compared to income tax expense of approximately RM4.7 million in FY2022. This was due to reversal of temporary difference in FY2023 and overprovision of deferred tax in respect of previous years. As a result of decrease in the provision of deferred tax liability, income tax expense for FY2023 decreased by approximately RM7.4 million, or 157.5%

Loss for the year

With the lower revenue and a less than proportionate decrease in costs and expenses, the Group recorded a net loss in FY2023 of approximately RM8.2 million as compared to a net profit in FY2022 of RM8.2 million.

Review of changes in turnover and earnings by business and geographical segments

- By Business Segment

The Group’s revenue decreased by approximately RM35.7 million in FY2023 as compared to FY2022 mainly due to the decrease in the Furniture segment.

The Group recorded loss before interest and tax of RM9.8 million in FY2023 as compared to earnings before interest and tax of RM15.1 million in FY2022 mainly due to the loss recorded from both the Furniture and Millwork segments. - By Geographical Segment

The Group experienced a decrease in sales across all major geographical segments such as the United States of America, Malaysia, Republic of China and Hong Kong. However, this was partially offset by an increase in sales to Japan.

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITION

Review of the Group’s financial position as at 31 December 2023 as compared to 31 December 2022

Non-current assets

Property, plant and equipment decreased by approximately RM10.8 million, or 7.0%, mainly due to depreciation charged in FY2023.

Right-of-use assets of approximately RM22.7 million comprised the right to use the properties and land use rights of the Group over the respective lease period. The decrease in right-of-use assets of approximately RM6.3 million, or 21.7% was due to lesser depreciation charged in FY2023 and early termination of tenancy agreements.

Intangible assets of approximately RM2.8 million consists of trademarks and goodwill arising from a business combination as announced on 28 January 2019.

Current assets

Inventories decreased by approximately RM39.0 million, or 43.9%, mainly due to the following:

- decrease in purchase of raw materials throughout FY2023 as the Group has stocked up raw materials in last financial year and a lower demand during the year; and

- improvement in the global supply chain whereby timing of delivery of raw materials and finished goods has gradually return to normal resulting in less stock up of raw materials by the Group.

Trade and other receivables of approximately RM19.9 million comprised trade receivables, deposits and other receivables. The increase in trade and other receivables by approximately RM1.6 million, or 8.9% was mainly due to increase in advance payment paid to suppliers for purchase of raw materials towards the end of FY2023.

Prepaid operating expense of approximately RM2.1 million comprised mainly expenses paid in advance as at 31 December 2023.

Tax recoverable, being prepaid current income tax of approximately RM2.2 million comprised tax paid in advance by the Malaysian subsidiaries for the Year of Assessment 2020, 2021, 2022 and 2023. The decrease in tax recoverable by approximately RM3.2 million, or 59.8% was mainly due to the tax paid in advance being refunded from the Inland Revenue Board of Malaysia.

Current liabilities and non-current liabilities

Loans and borrowings comprised bankers’ acceptance, financing arrangements and long-term loans. The decrease in loans and borrowings by approximately RM14.1 million, or 34.9% was mainly due to the net decrease in the usage of bankers’ acceptances of approximately RM5.2 million and scheduled repayment of loans and borrowings.

Trade and other payables of approximately RM36.7 million comprised trade payables and other payables. The increase in trade and other payables of RM2.5 million, or 7.2%, was mainly due to the increase in purchase of raw materials towards the year end.

Contract liabilities comprised the Group’s obligation to transfer goods or services to customers for which the Group has received consideration from customers for finished goods which required further improvements on customers’ request and pending the customers’ acceptance. As at 31 December 2023, the Group had fulfilled customers’ request completely and that they had accepted the finished goods.

Lease liabilities of approximately RM5.6 million comprised the liabilities that the Group has to pay over the respective lease period for the use of the properties. The decrease in the lease liabilities of RM6.0 million, or 51.8%, was mainly due to the corresponding scheduled repayment of lease liabilities in FY2023 and early termination of tenancy agreements.

Accrued operating expenses of approximately RM1.1 million comprised accrued operating expenses.

CONDENSED INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

Review of the Group’s cash flow statement for FY2023

The Group recorded net cash flows generated from operating activities of approximately RM48.3 million in FY2023 as the Group decreased its purchase of raw materials as explained above and had lower level of inventories as at 31 December 2023.

The Group recorded net cash flows used in investing activities of approximately RM0.5 million in FY2023 mainly due to purchase of property, plant and equipment which was partially offset by interest income received.

The Group recorded net cash flows used in financing activities of approximately RM19.4 million mainly due to repayment of loans and borrowings in FY2023. However, it was partially offset by the proceed from loans and borrowings.

Commentary

- The demand for our products has declined due to the high inventories build up by most furniture importers in the US during the pandemic years and, while their inventories level is declining, has persisted to affect demand. Accordingly, any future demand will be dependent on the inventory reduction by our customers in the US as well as the economic conditions in the US in the coming months. Growth in private consumption and investment has moderated in view of the tightening in monetary policy in response to the ongoing inflationary pressures. Though inflation has started to ease and there have been discussions of a reduction in interest rates in 2024, there is still concern of any potential recession in the US in 2024. Accordingly, consumer demand may be affected.

- The prolonged Ukraine-Russia war, the ongoing Israel-Hamas war and the recent escalation of the Red Sea attacks have created uncertainties in the recovery of the world’s economy from the pandemic. All these wars or attacks has the potential to further increase the oil & gas prices, logistics and transport costs as well as spread into a wider regional war. As a result, while the wars have no direct effect on the Group since the Group does not have any business in Russia, Ukraine, Israel and Palestine, the negative effects, particularly inflation and the geopolitical uncertainties have created uncertainties in the supply and demand of the Group’s products and raw materials inputs.