Financials

Unaudited Financial Statements And Dividend Announcement For The Six Months Ended 30 June 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

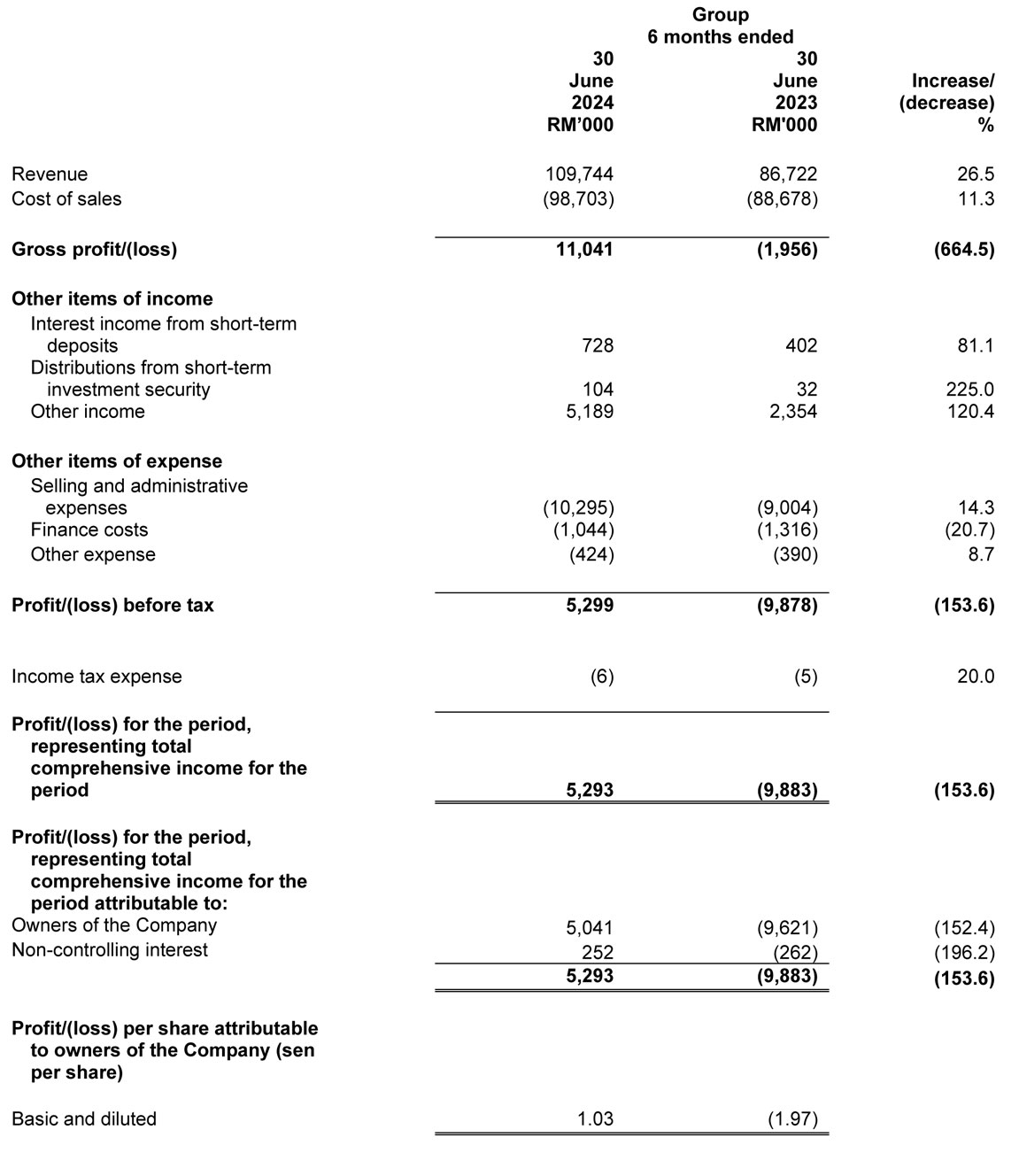

CONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

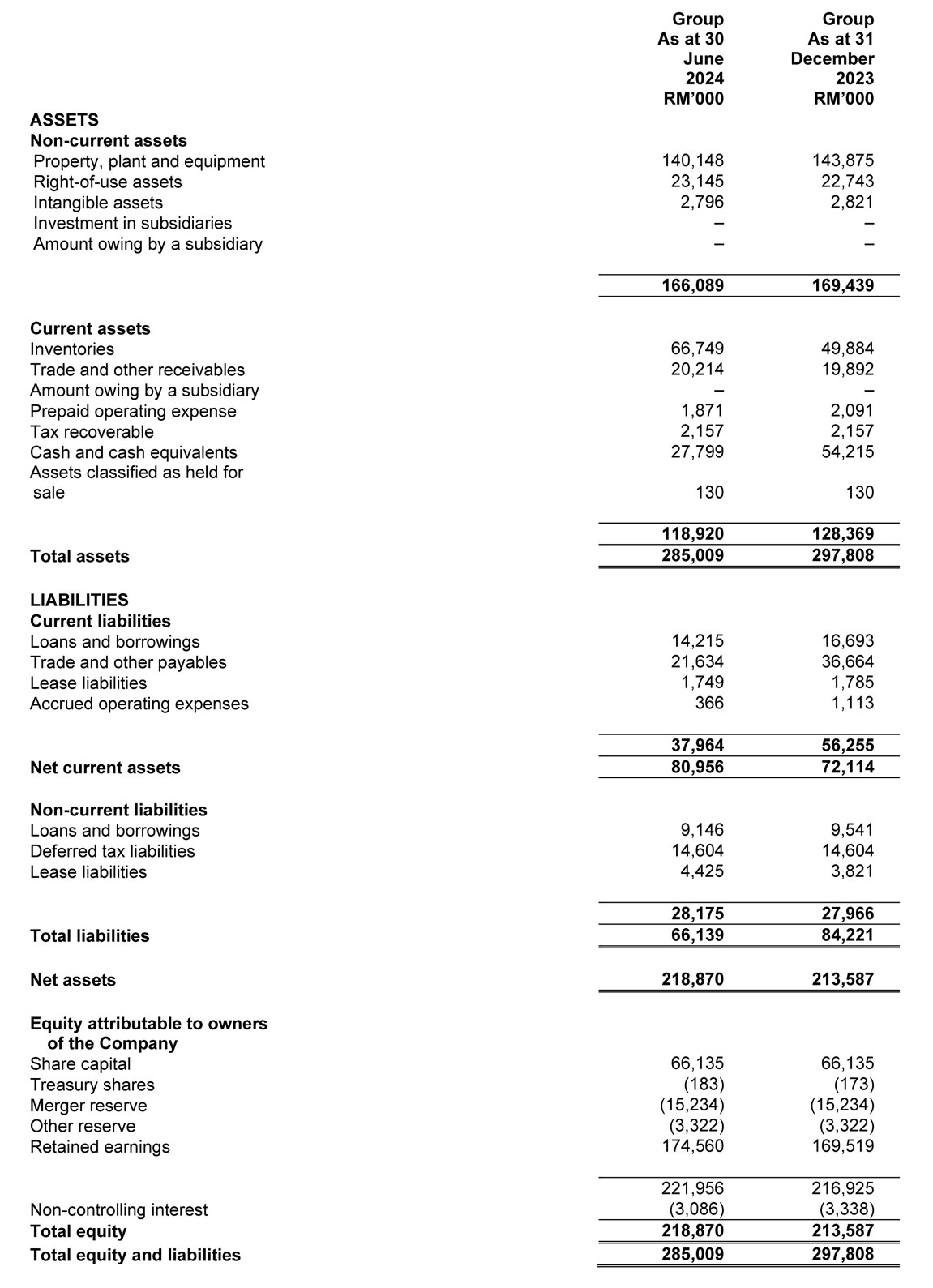

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITION

Review of Performance

CONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

Review of Group’s performance for the 6 months ended 30 June 2024 (“1H2024”) as compared to the 6 months ended 30 June 2023 (“1H2023”)

RevenueThe Group’s revenue increased by approximately RM23.0 million, or 26.5% due mainly to the finalisation of a variation claim with a customer in 1H2024. The variation claim was in relation to containers which had undergone re-work as a result of shipment delays caused by the COVID-19 lockdown.

Excluding the above variation claim, the Group’s revenue increased by approximately RM12.5 million, or 14.5%. This was mainly attributable to the increase in the average selling price per 40-ft container which increased from RM80,000 in 1H2023 to RM88,000 in 1H2024 as a result of the different product mix (more revenue from the Millwork segment as compared to a decrease in the revenue from the Furniture segment) sold by the Group. The number of 40-ft containers sold also increased from 1,085 40-ft containers in 1H2023 to 1,122 40-ft containers in 1H2024. The Group also benefitted from the higher exchange rate for USD in 1H2024 as compared to 1H2023. As a reference, the closing exchange rate of US$1 against the Malaysian Ringgit was RM4.66903 as at 30 June 2023 and strengthened to RM4.715 as at 30 June 2024. *

Note: * Source: www.oanda.com. OANDA Corporation has not consented to the inclusion of the information in this announcement.

Cost of sales and gross profits

Cost of sales increased by approximately RM10.0 million, or 11.3%, mainly due to more material used (due to different product mix) and labour cost in line with increase in revenue in the Millwork segment as well as an increase in carriage inwards charges for increase in purchase of raw materials.

The Group’s gross profit increased by approximately RM13 million, or 664.5% mainly due to the finalisation of a variation claim in 1H2024 as mentioned above. This was because the Group had recognised the cost of sales in relation to the variation claim in prior years.

Excluding the revenue and gross profit from the variation claim, the Group recorded a gross profit margin of 0.6% in 1H2024 as compared to a gross loss margin of 2.3% in 1H2023 with the higher percentage increase in revenue as compared to our cost of sales,

Interest income

Interest income increased by approximately RM0.3 million, or 81.1%, mainly due to higher cash placements in short term fixed deposits in the bank account maintained in Malaysia in 1H2024.

Distributions from short-term investment security

Distributions from short-term investment security comprised income received for funds placed with Money Market Funds during 1H2024.

Other income

Other income comprised mainly government grants, rental income, scrap and foreign exchange gain as well as charges for services provided such as transportation.

Other income increased by approximately RM2.8 million, or 120.4%, mainly due to the increase in machine rental received and foreign exchange gain.

The Group registered net foreign exchange gain of RM2.2 million in 1H2024 as compared to net foreign exchange loss of RM0.4 million in 1H2023 due to decrease in USD-denominated other payables as well as USD-denominated loans and borrowings.

Selling and administrative expenses

Selling and administrative expenses increased by approximately RM1.3 million, or 14.3%, mainly due to the higher provision for bonus and upkeep of building in 1H2024.

Depreciation expenses

Depreciation expenses decreased by approximately RM0.6 million, or 7.7% mainly due to the decrease in depreciation expenses for right-of-use assets due to lesser number of tenancy agreements in 1H2024.

Finance costs

Finance costs decreased by approximately RM0.3 million, or 20.7% mainly due to lesser number of tenancy agreements and decrease in term loans balances. However, the decrease was partially offset by an increase in interest rate charged on the term loans in 1H2024.

Other expense

Other expense increased by approximately RM34,000, or 8.7% mainly due to the loss on disposal of property, plant and equipment in 1H2024.

Profit/(loss) for the period

As a result of higher percentage increase in revenue as compared to our cost of sales as well as the variation claim, the Group incurred net profit of approximately RM5.3 million in 1H2024 as compared to a net loss of RM9.9 million in 1H2023.

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITION

Review of the Group’s financial position as at 30 June 2024 as compared to 31 December 2023

Non-current assetsProperty, plant and equipment decreased by approximately RM3.7 million, or 2.6%, mainly due to depreciation charged in 1H2024.

Right-of-use assets of approximately RM23.1 million comprised the right to use the properties and land use rights of the Group over the respective lease period. The increase in right-of-use assets of approximately RM0.4 million, or 1.8% was mainly due to a new tenancy agreement entered in 1H2024.

Intangible assets of approximately RM2.8 million consists of trademarks and goodwill arising from a business combination as announced on 28 January 2019.

Current assets

Inventories increased by approximately RM16.9 million, or 33.8%, mainly due to increase in purchase of raw materials in 1H2024 in line with increase in sales.

Trade and other receivables of approximately RM20.2 million comprised trade receivables, deposits and other receivables. The increase in trade and other receivables by approximately RM0.3 million, or 1.6% was mainly due to increase in trade receivables in line with higher sales in 1H2024. However, this was partially offset by a decrease in levy paid in advance.

Prepaid operating expense of approximately RM1.9 million comprised mainly expenses paid in advance as at 30 June 2024.

Tax recoverable, being prepaid current income tax of approximately RM2.2 million comprised tax paid in advance by the Malaysian subsidiaries for the Year of Assessment 2020, 2021, 2022 and 2023.

Current liabilities and non-current liabilities

Loans and borrowings comprised bankers’ acceptance, financing arrangements and long-term loans. The decrease in loans and borrowings by approximately RM2.9 million, or 11.0% was mainly due to the scheduled repayment of loans and borrowings. However, the decrease was offset by the net increase in the usage of bankers’ acceptances of approximately RM1.9 million.

Trade and other payables of approximately RM21.6 million comprised trade payables and other payables. The decrease in trade and other payables of RM15.0 million, or 41.0%, was mainly due to the decrease in credit purchase of raw materials and payment of insurance payable as well as a decrease in other payables due to the finalisation of the variation claim as mentioned above.

Lease liabilities of approximately RM6.2 million comprised the liabilities that the Group has to pay over the respective lease period for the use of the properties. The increase in the lease liabilities of RM0.6 million, or 10.1%, was mainly due to a new tenancy agreement entered in 1H2024.

Accrued operating expenses of approximately RM0.4 million comprised accrued operating expenses.

CONDENSED INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

Review of the Group’s cash flow statement for 1H2024

The Group recorded net cash flows used in operating activities of approximately RM20.4 million in 1H2024 as the Group increased its purchase of raw materials as explained above and had higher level of inventories as at 30 June 2024.

The Group recorded net cash flows used in investing activities of approximately RM1.6 million in 1H2024 mainly due to purchase of property, plant and equipment.

The Group recorded net cash flows used in financing activities of approximately RM4.9 million mainly due to repayment of loans and borrowings in 1H2024. However, it was partially offset by the proceed from loans and borrowings.

Commentary

- The principal market of the Group’s products is the United States of America (the US). As mentioned in earlier paragraph, the Group registered lower revenue from the Furniture segment for 1H2024. The Company believes that the decrease was attributed to lower demand for the Furniture segment brought about by the uncertainties in the economic conditions in the US which has led to consumers in the US being more selective and careful in their purchases of customer products. News reported that US consumer sentiment fell to an eight-month low in early July 2024 as high prices continued to weigh on the outlook of the economy.

- The prolonged Ukraine-Russia war, the ongoing Israel-Hamas war and the Red Sea attacks have also created uncertainties in the recovery of the world’s economy from the pandemic. All these conflicts have the potential to further increase the oil and gas prices and extend delivery logistics resulting in higher delivery costs to the Group. As a result, while these conflicts have no direct impact on the Group since the Group does not have any business or customers in these conflicted countries, the negative effects, particularly inflation and the geopolitical uncertainties have indirectly affected the demand of the Group’s products as well as the supplies of our raw materials.